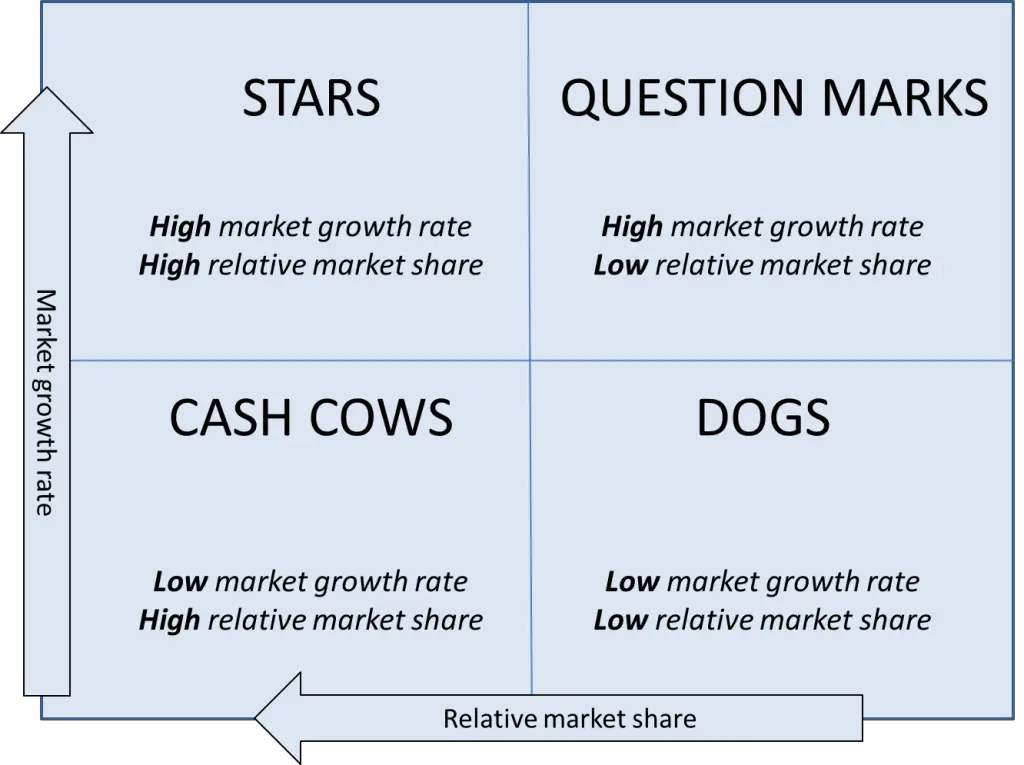

The output of the BCG matrix classifies businesses or brands or products into one of four quadrants.

The output of the BCG matrix classifies businesses or brands or products into one of four quadrants.

Each of these four quadrants are defined by the intersection of two marketing metrics – namely the market growth rate (a measure of market opportunity and potential) and relative market share (a measure of competitive strength).

The four quadrants that are used to classify the businesses or brands are designed to give some guidance to strategy and resource allocation across the full portfolio – as suggested by their names.

Cash cows

Cash cows are large businesses/brands in a stable mature market. Cash cows are classified by having large relative market shares (being number one or two in the marketplace) in a low growth market, usually where significant changes in market shares are unlikely.

Cash cows generate surplus cash – hence their name – they require some money for reinvestment but generally they provide the surplus funds to reinvest in other parts of the business. Ideally, a large company will look to have multiple cash cows.

Stars

Stars are the cash cows of the future. They have a high relative market share, in a fast-growing marketplace. That means that they have not reached their full potential and are generally competing in a highly attractive marketplace where there is plenty of competitive rivalry.

Because of this market situation, it is necessary to invest significant sums of money into stars. Typically they are still expanding their product line, expanding into new geographic markets, helping grow the overall market and attracting first-time consumers while defending their market share against aggressive competitors.

Therefore while stars are likely to generate significant revenues, they also require significant reinvestment and are unlikely to generate any surplus cash that can be reinvested in other parts of the business.

Dogs

Dogs are relatively low market share players in stable mature markets. They are likely to generate a small amount of profitability and some may even deliver substantial profits. However, they are termed dogs primarily because there is limited potential to grow, they generally have a number of competitive weaknesses, and their level of profitability is relatively minor as compared to a cash cow business/brand.

Question marks

Question marks are also sometimes referred to as the problem child. This is the most difficult quadrant of the BCG matrix to assess – as firms/brands classified in this quadrant have the advantage of being in a high-growth market, yet having a weak competitive position and well behind in the market share race.

Therefore, the question becomes “do we continue with this part of the business portfolio?”

On the one hand there is the argument that this is a highly attractive market and the firm should be a part of it. But the counterargument is that the firm is not competing well at this stage and it will be very expensive to try and catch up market share, which means that the firm may end up with a future dog.

If they are pursued, question marks will require a significant amount of investment and resource allocation, but with no guarantee of long-term success – hence why they are classified a question mark (or a problem child).

Black hole territory

The above discussion of the four quadrants assumes that the product portfolios are clearly classified into one of the four quadrants – making the strategic direction quite clear.

The above discussion of the four quadrants assumes that the product portfolios are clearly classified into one of the four quadrants – making the strategic direction quite clear.

However, there is a concern if the product portfolio is mapped equally between two quadrants or even in the center of the BCG matrix – as shown in the diagram – please refer to the discussion of BCG limitations on this website.