A key aspect in the customer lifetime value (CLV) calculation is time spent as a customer – commonly referred to as the customer’s lifetime. When we refer to the customer’s lifetime in a marketing context, we are considering the average length of time a consumer is a customer of the brand or a firm.

This length of time will have considerable impact on the overall customer lifetime value. Please note that this website contains a free Excel template that allows you to calculate customer lifetime value quickly and easily.

Obviously, the average customer lifetime is derived directly from the firm’s customer retention or loyalty rate (expressed as a percentage). The higher the degree of customer loyalty – that is, the greater percentage of customers that return year after year – then the longer the average customer’s lifetime will be with the company or brand.

Converting loyalty rate to lifetime in years

This is a relatively simple calculation. The opposite of the loyalty rate (sometimes referred to as retention rate) is the churn or loss rate of customers. For example, a company with a 60% retention rate has a 40% churn rate. The percentages should add up to 100%, as either customers are deemed to be loyal or are lost to a competitor.

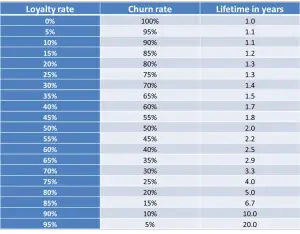

The number of times the churn rate goes into 100% is the average lifetime of the customer in years, as shown in the following table:

Key points to note about loyalty and the customer’s lifetime

Probably what should jump out at you from the above table; is that until you get relatively high levels of retention (or loyalty) – say over 70% or so – then the customer’s average lifetime is relatively low, typically under three years.

What you should also notice is that there are significant differences between the average customer lifetimes as the retention/loyalty rate gets a lot higher. For example, the difference between an 85% and a 90% customer retention rate increases the average lifetime by 50% – from 6.7 years to 10 years.

Ideal marketing goals

If a brand/firm has the ability to increase customer loyalty – which is a very common goal within a service marketing environment – then increasing customer retention will significantly add to the customer lifetime value IF the retention rate can be increased to in excess of 70%.

However, if the firm/brand has a very low retention – perhaps is in an industry that relies on first-time or new customers – then even increasing the loyalty rate from 20% to 50% will have only minor impact on the average value of a customer. This is because even at a 50% retention rate, the average customer will only buy from the firm or brand for two years.

Related topics

How to use the customer lifetime value template