Contents

Understanding Financial Metrics

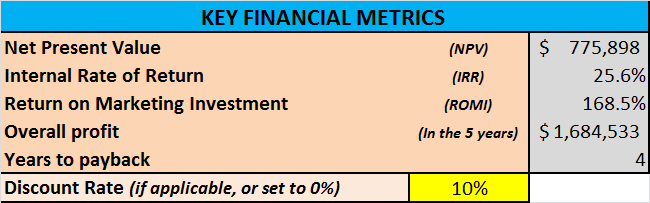

As you will see when you use the free Excel template for your ATAR forecasts, there are several financial metrics automatically produced at the bottom of the spreadsheet.

As you can see, these financial metrics include:

- net present value (NPV)

- pay-back period (in years)

- internal rate of return (IRR)

- marketing ROI

- overall profitability

If you have not studied finance, then there is a possibility that you have not covered these financial metrics previously and may be concerned about using them.

This is quite understandable, if you don’t know the terminology – therefore, please review the following article or the view the below video for more information on how to interpret these financial metrics.

Net Present Value (NPV)

Net present value is the first financial metric presented in the Excel ATAR forecasting template, at the bottom of the spreadsheet.

Net present value is a metric that summarizes the overall projected profitability of the new product forecast, in comparison to alternative investment opportunities for the firm, into a single number.

Net present value utilizes the discount rate, which you also need to input (in most cases you will use a 10% discount rate, but it is firm-dependent).

This single number output for NPV quickly tells us whether or not the project and the rate of return is in excess of discount rate. If we have set the discount rate to 10%, then a positive NPV (that is, greater than zero) demonstrates that the project should deliver a return in excess of 10%.

This is a handy financial metric to use when comparing multiple possible marketing options. The discount rate is typically the average rate generated by the business in the course of their normal business operations.

Therefore, if we can show that this new product has the ability to earn more than the normal rate of return, then we can justify the financial investment in the new product and its development.

The net present value output takes into account both revenues and costs. Therefore it is a relatively complete measure and provided it is greater than zero, it indicates the firm would improve its financial position by investing in this project.

Internal rate of return (IRR) of the ATAR forecast

The next financial metric provided by the ATAR forecast template is the internal rate of return. This is the percentage that the project/new product makes on its investment over time.

Think of it like putting your savings in a bank, where you may be paid 10% interest per year. After about seven years (without tax implications) your savings will roughly double. While your return has been 100% (it has doubled), on average it has achieved a 10% return on an annual basis (which compounds).

This is what the internal rate of return works out – what is the average percentage return on this project/new product each year? Obviously, we are looking for a generally strong result for this financial metric.

If the internal rate of return was equal to your discount rate of 10%, then our overall net present value would be zero.

This means that we need an internal rate of return on the new product to be in excess of the discount rate, in order to generate a positive net present value to justify the new product development from a financial perspective.

Return on marketing investment (ROI or ROMI)

ROMI is a relatively simplistic metric that simply looks at the total profit accumulated by the product in its first five years in comparison to the initial investment amount in year 0. Again we are looking for a relatively strong number here to demonstrate that the new product is financially viable.

In some organizations, this profitability metric would be considered to be too simplistic as it does not take into account the time-frame – therefore, in some cases, you may need to utilize the net present value and internal rate of return metrics as well.

Overall profit of the new product

Overall profit is the profit contribution for the new product over five years. It incorporates profit contributions (based on unit margins) each year, less any expenditure on promotion and less initial investment.

Therefore, it shows how much net “cash” has been generated by the new product in the five year time frame.

Pay-back period

Pay-back period is the amount of time – in years – that it takes for the new product to pay for itself. In other words, if the new product cost $1 million in development, then how many years will it take for the profit from this new product to recover this $1 million – when will we be back to break even?

Firms naturally like to see a relatively short payback. This is because a short pay-back reduces the firm’s risk, it more quickly frees up money for further investments, and it reduces the concerns about changing market conditions.

Key Financial Metrics for Marketing VIDEO

Related topics

- How the free Excel ATAR template works

- Do I need to use the ATAR financial metrics?

- Importance of financials in the new product decision

- Sales and Profit Forecasting

- How the ATAR Forecasting Model Works