Firms will often have the goal of increasing market share. Increased market share is primarily delivered through winning a greater proportion of the market’s business. In particular, one or more of the following situations must occur for a firm/brand to increase its market share:

- A greater proportion of consumers decide to purchase the brand

- The brand wins a greater “share of customer” and/or

- The brand attracts a higher proportion of “heavy user” consumers

In many cases, the brand/firm tends to pursue an aggressive market share goal primarily through the acquisition of first-time customers – that is, providing existing consumers with an incentive to purchase the brand. This incentive is typically structured around a sales promotion, a product line extension, increased availability, or is generated by a cut through marketing communications campaign.

Contents

Not all consumers are available

When setting market share goals, it is important to consider the proportion of consumers who are either willing or in a position to switch brands. In some circumstances, such as the fast-moving consumer goods industry, brand switching is relatively easy. But in service firms where there may be contractual arrangements, such as a mobile phone contract, switching is more difficult and less frequent.

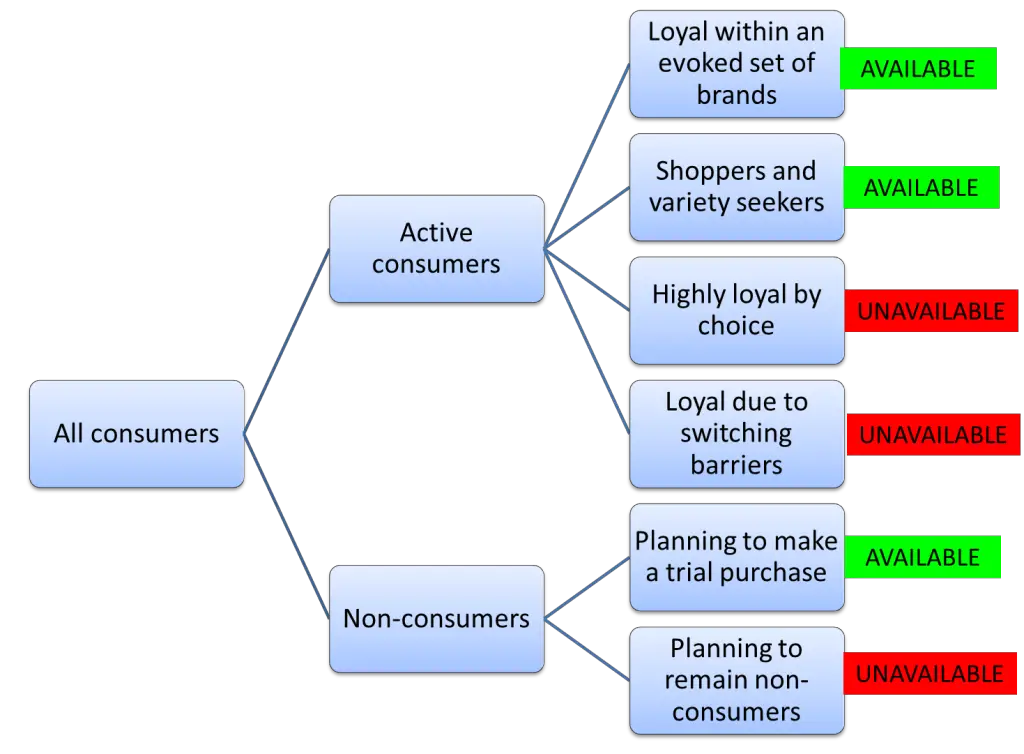

If we look at the overall diagram of the market we can initially classify consumers into the two broad groups of active/current consumers and non-consumers.

Active/current consumers are those consumers who are purchasers of the product category either on a frequent or occasional basis. And non-consumers are consumers who are within the target market but do not purchase the product category. For example, young adults are typically a prime target market for fast food chains, but a proportion of this target market would not make any fast food purchases – therefore these potential consumers would be classified as non-consumers.

Active and non-consumers and the product life-cycle

Within the growth phase of the product life-cycle (PLC), it is common for non-consumers to buy the product category for the first time and become active consumers. In essence, this is what drives the market during its growth phase – it is the reason the market grows so quickly in this stage of the PLC.

However, in a mature market, the activation of non-consumers is relatively small, as these consumers have generally decided that this is not a product category that they are only interested in.

Degrees of Consumer Loyalty and Availability

Referring again to the diagram, active/current consumers can then be classified into four categories:

- Loyal to a set of brands

- Shopper or variety seeker

- Highly or emotionally loyal or

- Locked in by switching barriers

As you can see, those consumers who are highly/emotionally loyal or locked in by switching barriers (contracts, time/effort) will be generally unavailable and cannot be considered as a growth opportunity when trying to expand a brand’s market share.

This leaves just two categories of available active consumers which are:

- Those who have an evoked set of brands (a set of suitable brands that they will frequently buy) and

- Those consumers who frequently shop around due to a price deal or variety.

A firm/brand will need to put the appropriate marketing tactics in place in order to win a greater proportion of these consumers.

Market research helps define the available market

Various forms of market research – typically surveys – can be used to measure the size of the available and unavailable marketplace. Size of the overall available market will give some guidance to the organization to what extent an increase in market share is possible.