Contents

What is the Herfindahl-Hirschman index (HHI)?

The Herfindahl index (or HHI) is a variation of the market concentration marketing metric and is used to assess the level of competitiveness of a particular industry. It is named after economists Orris C. Herfindahl and Albert O. Hirschman, who developed the index independently in the 1950s.

Instead of a simple sum of the market shares of the larger brands in the marketplace, the Herfindahl index applies a multiple (squared) effect to the difference in the market shares for all/most brands.

It is a relatively simple calculation to perform by a spreadsheet and once it is set up a can be tracked over time and several industries can be compared on this index.

The Herfindahl-Hirschman index formula

The Herfindahl-Hirschmanindex is calculated by:

- The sum of the squares of each brand’s market shares

- Or as a math formula = HHI = (s₁² + s₂² + s₃² + … + sₙ²)

The rationale behind squaring the market shares is based on the assumption that larger firms have a proportionately greater impact on market dynamics and competition compared to smaller firms.

As a result, squaring the market shares amplifies the effect of larger firms and their dominance in the market, while simultaneously diminishing the influence of smaller firms.

Therefore, the best way to think about the HHI formula is that it reweights the firm’s market shares, giving more weight (impact) to the larger firms, while reducing the weight (impact) of smaller players.

Notes on the Herfindahl-Hirschman index

- Usually only the top 50 brands are included in the calculation of the index

- The maximum index score = 1 (which occurs in the case of a monopoly)

- The minimum index score = 1/number of brands (which occurs if all brands have an equal market share, which is highly unlikely)

How to Read the Herfindahl-Hirschman index (HHI)

- HHI = 1 = a monopoly

- HHI = around 0.50 to 0.90 = most likely a duopoly market structure

- HHI = 0.25 to 0.75 = most likely a oligopoly market structure

- HHI = above 0.25 = a highly concentrated market

- HHI = 0.15 to 0.25 = a moderately concentrated market

- HHI = below 0.15 = an unconcentrated market

Example 1 of the Herfindahl-Hirschman index

Let’s use an example marketplace with five brands – their market shares are as follows:

- Brand A = 40% (0.40)

- Brand B = 30% (0.30)

- Brand C = 20% (0.20)

- Brand D = 7% (0.07)

- Brand E = 3% (0.03)

The Herfindahl index is the calculated by squaring each of the market shares as follows:

- 0.40 X 0.40 + 0.30 X 0.30 + 0.20 X 0.20 + 0.07 X 0.07 + 0.03 X 0.03 =

- 0.160 + 0.090 + 0.040 + 0.0049 + 0.0009 =

- 0.2958 =

- 0.30 (rounded)

Given that there are five brands in the market, the minimum Herfindahl index would be 1/5 = 0.20 – see below for how to use this index.

Example 2 of the Herfindahl-Hirschman index

In this second example, let’s use five brands again, but this time have a more concentrated market, as follows:

- Brand A = 60% (0.60)

- Brand B = 30% (0.30)

- Brand C = 8% (0.08)

- Brand D = 1% (0.01)

- Brand E = 1% (0.01)

For this second example, the Herfindahl index is calculated as follows:

- 0.60 X 0.60 + 0.30 X 0.30 + 0.08 X 0.08 + 0.01 X 0.01 + 0.01 X 0.01 =

- 0.360 + 0.090 + 0.0064 + 0.0001 + 0.0001 =

- 0.4566=

- 0.46 (rounded)

And given that there are still five brands in the market, the minimum Herfindahl index in this example would also be 1/5 = 0.20 – see below for how to use this index.

Using the Herfindahl-Hirschman index scores

The H-index for market concentration is best used as a comparative measure. In the two examples above, the first market had an index score of 0.30 (max = 1, min = 0.20) and the second market had an index score of 0.46 (max = 1, min = 0.20).

Therefore, the second market is far more concentrated that the first market.

The H-index removes the subjective decision of how many brands to include in the calculation, which is a limitation of the more basic approach to measuring market concentration.

As you can see from the two examples above; a firm with a large market share will add significantly to the overall index. However, relatively minor market shares will have very little impact. Therefore, several large players are required to generate a higher index score.

This index can be compared to the minimum score that could be generated it all brands were equal in market share. For example, a market with just ten brands, with each brand having a 10% market share – when multiplied by itself (squared) each market share becomes 10% X 10% = 0.01 and all 10 brands would add up to an index of just 0.10.

Reading the Herfindahl-Hirschman index scores

In the above example, we used a comparative approach. But as a general guide, the HHI index is assessed using the following scale:

- HHI = Less than 0.150 = a competitive (low concentration) market

- HHI = 0.150 to 0.250 = a medium/moderate concentrated market

- HHI = More than 0.250 = a highly concentrated market

Note: sometimes this index is presented as being multiplied by 10,000.

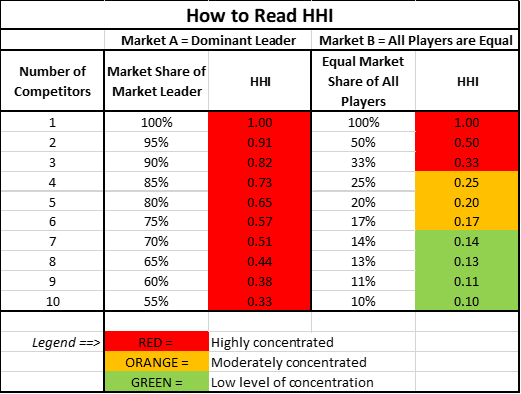

This table provides a comparison of two markets, both with the same number of competitors.

Market A has a dominant market leader. In each case, the other competitors hold 5% market share each and the market leader holds the balance of market share. For example, for five competitors, the market leader has 80%, and the other for firms hold 5% each, totaling 20%.

In Market B, there is the same number of competitors shown (comparing one to 10 competitors), except in this market all players have an equal market share. For example, for five competitors, each player has 20% share of the market, totaling 100% between them.

As can be seen, Market A is always a highly concentrated market, because it always contains a substantial and dominant competitor versus smaller players who only have a maximum of 5% of the market each.

Whereas for Market B, once we reach four competitors who are all equal, the measure drops to moderately concentrated, and when we reach seven equal competitors, it is considered a relatively low level of concentration.

FAQs for the Herfindahl-Hirschman index (HHI)

What is the Herfindahl-Hirschman Index (HHI)?

The HHI is a measure of market concentration used to assess the competitiveness of an industry or market.

How is the HHI calculated?

The HHI is calculated by summing the squares of the market shares of all firms within a given market.

What does a high HHI score indicate?

A high HHI score suggests greater market concentration and lower levels of competition.

What does a low HHI score indicate?

A low HHI score indicates a more competitive market with a greater number of firms and less concentration.

What are the implications of a high HHI score?

A high HHI score may suggest a less competitive market, potentially leading to concerns about market power, reduced innovation, and higher prices for consumers.

Are there other measures of market concentration besides the HHI?

Yes, other measures include the Concentration Ratio, which sums the market shares of a specific number of the largest firms.

How can a marketer use the HHI to understand market competitiveness?

A marketer can use the HHI to gauge the level of market concentration and competition in a particular industry.

A higher HHI score may indicate a less competitive market, while a lower HHI score suggests a more competitive landscape. This information can help marketers assess market dynamics, potential barriers to entry, and the degree of competition they may face.

Can the HHI assist marketers in identifying market opportunities?

Yes, by analyzing the HHI scores of different markets or industries, marketers can identify areas with lower levels of concentration and potentially higher competition.

Lower HHI scores may indicate opportunities for new entrants or businesses looking to expand into less concentrated markets where competition is more intense. Marketers can prioritize their efforts and resources accordingly.

How can the HHI help marketers evaluate market entry strategies?

The HHI can aid marketers in assessing the viability and potential challenges of entering a new market. If the HHI score is relatively high, indicating high concentration, it may suggest the presence of dominant players with significant market power.

Marketers can then consider strategies such as niche targeting, differentiation, or collaborations to penetrate the market effectively. Conversely, lower HHI scores may indicate a more open and competitive market, making it potentially easier for new entrants to gain market share.

Related topics

- What is market concentration?

- The free Excel template for calculating market concentration.

- Do I Need to Measure Market Share?

- Examples for calculating market shares

- Decomposing Market Share