The BCG matrix is not designed to be a static model and it can be used to track portfolios over time. This is important because relative market share and market growth rates are dynamic. It also allows the tracking of the products portfolios against overall goals and against competitors over time.

Most likely transition in the BCG Matrix

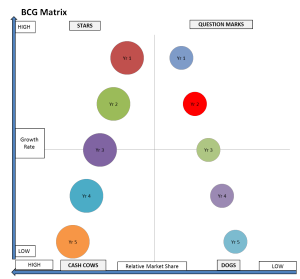

This example BCG matrix Shows the most likely transition of a star and a question mark portfolio over time.

This example BCG matrix Shows the most likely transition of a star and a question mark portfolio over time.

As we know, stars are destined to become future cash cows and therefore the major profit drivers of the business in the future. The strategic intention behind a star is to either hold or build its relative market share and as the market matures the star will eventually evolve to become the cash cow, as shown.

However, the more difficult decision lies with the question mark and whether it is worthwhile investing in trying to build the business. In reality, most firms are not willing to take the chance on a question mark portfolio. As a result, question marks gradually lose market share and typically end up as dogs – is also shown in the BCG matrix example.

Ideal path of a question mark

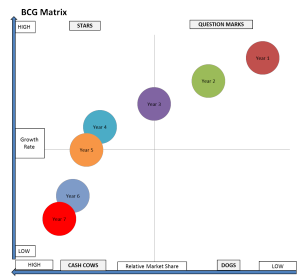

Some firms will see question marks as having significant potential – this often happens with larger firms who are late entrants to a market that is transitioning from the introduction phase to the growth phase.

Some firms will see question marks as having significant potential – this often happens with larger firms who are late entrants to a market that is transitioning from the introduction phase to the growth phase.

This means that initially they start out as a question Mark, as identified in this BCG matrix example. However, through various competitive strengths and competitive will, the portfolio is developed and provided with significant investment and gains market share quite rapidly.

The end result is that by the time the market matures the ones? Has become a star and then will go on to be a cash cow and provide significant levels of profitability to the firm

A neglected star

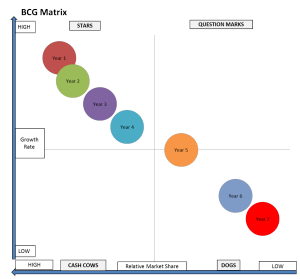

Just as a question Mark can boldly into a star and then onto a cash cow, the reverse pattern can apply to the star, as illustrated in this BCG matrix example.

Just as a question Mark can boldly into a star and then onto a cash cow, the reverse pattern can apply to the star, as illustrated in this BCG matrix example.

In this example, the firm has failed to reinvest adequately in the portfolio – or has been outspent by a major competitor.

Either way the outcome is the same, where the star’s relative market share starts to erode and its progresses to a question mark and then ultimately to a dog.

[mailerlite_form form_id=1]