What’s the Difference Between Market Share and Relative Market Share?

Market share and relative market share are related metrics used to evaluate a company’s performance and position within a specific market. However, they differ as follows:

Market Share

Market share represents the proportion of total market sales or revenue that a company captures within a specific market or industry. It is typically expressed as a percentage and is calculated as follows:

- Market Share = (Company’s Sales / Total Market Sales) * 100

Relative Market Share

Relative market share, on the other hand, compares a company’s market share to that of its largest competitor within the same market. It is calculated by dividing the company’s market share by the market share of the largest competitor.

- Relative Market Share = (Company’s Market Share / Largest Competitor’s Market Share)

Relative market share helps assess the brand’s competitive strength and how well the brand is performing compared to its biggest competitor (in terms of market share).

So Why Should Marketers Look at Relative Market Share?

Reason 1 = As a benchmark against the market leader

Relative market share is a marketing metric that is essentially used as a benchmark against the market leader.

Market shares will move around for many reasons and underlying factors, but this metric allows the brand to track their performance against the biggest brand in the marketplace.

It allows firms to answer the question: While we are gaining/holding/losing market share; how do we compare to the market leader?

Large brands have many substantial advantages – such as, a greater customer following, stronger retailer relationships, the ability to charge a price premium, greater success rates with product line extensions, greater opportunities for social media and publicity, larger promotional budgets, and so on.

Given this set of competitive advantages, these firms/brands should be able to slowly increase their market dominance over time – but market leaders also have to compete on more competitive fronts and are frequently challenged, particularly in niche markets.

Therefore this metric allows an individual brand to track its performance against the market leader – or against a selected competitor.

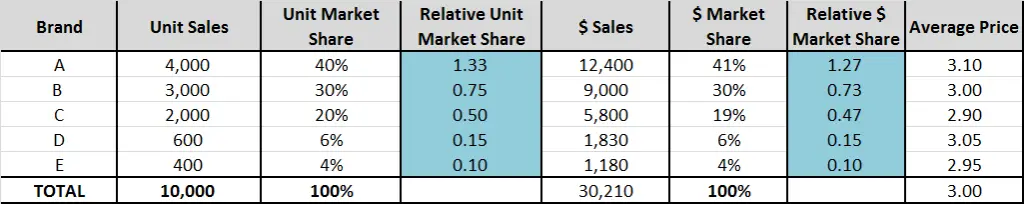

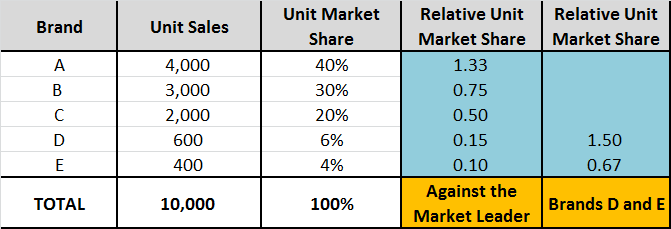

As can be seen in the above tables, Brand D and Brand E both have very low relative market shares, as compared to Brand A who is the market leader. Their relative market shares are 0.15 and 0.10 (or 15% and 10%).

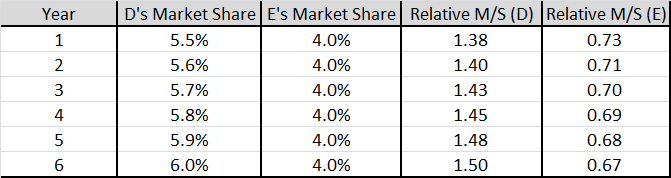

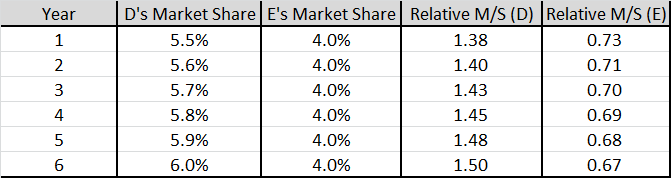

But in the second table we look at the relative market shares of these two brands only – as they are likely to be direct competitors. This helps tell a different story – where Brand D is strengthening its relative brand position – having improved its relative market share from 1.38 to 1.50 over the last six years.

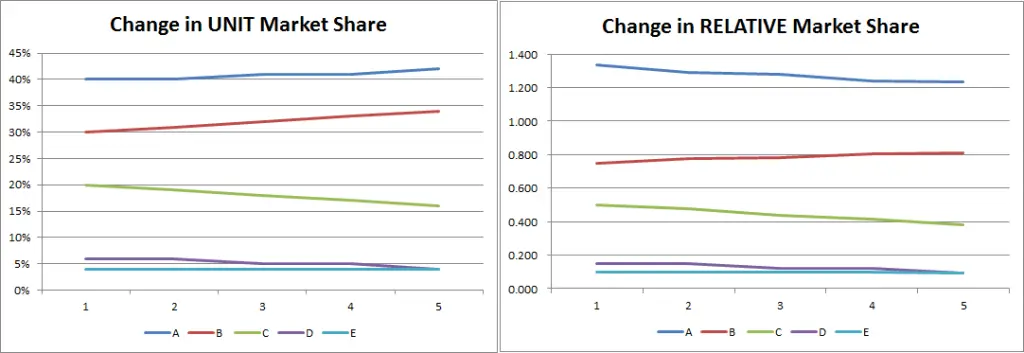

Compare these two graphs – the first shows the change in unit market share and the second shows the change in relative market share – they are both based on the same underlying market share figures.

As you can see the market leader looks like it’s improving its market share position in the first graph, but on a relative basis (relative to the second brand in the marketplace), it is slowly losing its relative competitive advantage.

Reason 2 = As a comparison between portfolios

Relative market share is also a very effective metric for large firms when they have multiple portfolios and lots of brands operating in the marketplace.

Take the following scenario as an example:

A firm has two brands in two different markets – both with a 25% market share.

- In the first market they are the market leader, and the second player has a market share of 20%. This would mean that the relative market share would be 25%/20% = 1.25.

- In the second market, however, they are the number two brand and the market leader has a market share 50%. In this case the relative market share would be 25%/50% = 0.5.

As you can see, in both cases their market share is 25%, but there are substantial differences in their relative market share which gives an executive a very quick read of how dominant the brand is in the marketplace.

The relative market share of 1.25 indicates that they are of the market leader and in good competitive position; whereas the relative market share of 0.5 indicates that they are a reasonably strong player up against a very dominant market leader.

Reason 3 = As a measure against key competitors

Smaller brands in particular probably get very little value out of the formal relative market share metric, because they may not be interested in the comparison to the market leader. They would rather compare themselves directly to a competitor. Please refer to the separate article on relative market shares and direct competitors.

So why is a relative market share metric of more value than an actual market share metric?

Let’s use the example of Brand D and Brand E as shown in these tables. In the first table , you can see that they are both minor brands in this market (with 6% and 4% market shares) and minor relative market shares (at 0.15 and 0.10).

However, let’s look at the next table which provides some history for these two current market shares. As you can see, Brand E is actually holding their market share steady at 4.0%, while Brand D has gained a small extra share of the market over the last six years – growing from 5.5% to 6.0% market share.

But given that both Brand D and Brand E are relatively small players in the marketplace, they would be more interested in tracking their performance against each other, rather than against the market leader.

As a result, the relative market share metric appears to be of greater value – where Brand D’s market share (relative to Brand E) has increased from 1.38 to 1.50 over the past six years, while Brand E’s relative market share has deteriorated from 0.73 to 0.67.

This shows that Brand E’s relative competitive position is actually weakening, despite the fact that their overall market share has stayed flat at 4.0%.

Related Topics

- What is relative market share?

- Relative market share and the BCG matrix

- Tracking direct competitors with relative market share

- Using unit or revenue relative market share?