What are Reference Prices in Marketing?

In marketing, a reference price is defined as any price information accessed or used by consumer to assist them to compare and evaluate the value offered by a product at a particular price point.

The word “reference” means that the consumer is referring to existing internal knowledge, or to available external information, or a combination of both, to help assess the price of a product.

As we know, consumers are seeking perceived value whenever they make a purchase. Value is obtained by the consumer when the benefits of the product exceed the costs of acquiring the product.

Therefore, it is important for marketing success that consumers perceive that the price is appropriate, fair, and consistent with prior relevant prices, and consistent with similar competitor offerings.

A Model of Reference Prices

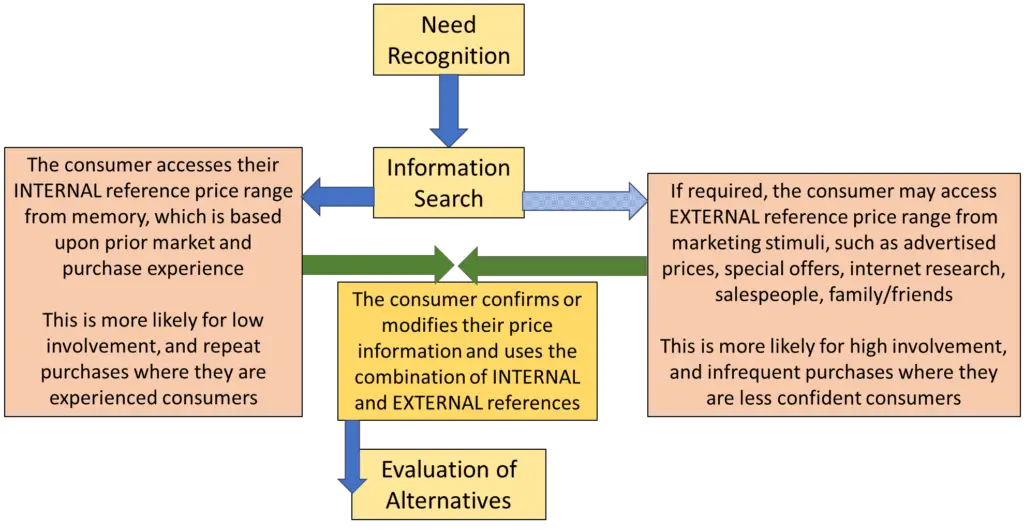

Here is a model that demonstrates the role of reference prices and how consumers use this information to inform and guide their purchase decisions.

Based Around the Buyer Decision Process

As you can see, this model is also based around the buyer decision process, which always starts with problem or need recognition by the consumer. Following the recognition that the consumer has a need, they proceed to the information search phase.

As indicated in the model, if the purchase decision is a low involvement one, or is a purchase that they had made many times before and have strong experience as a consumer, then the consumer will rely upon INTERNAL reference price information.

This means that the consumer will simply compare the price offering to their memory of appropriate and suitable price points for products in this category.

Most consumers will use this approach when purchasing products in a supermarket for instance. This is because it substantially speeds up decision-making and the overall shopping experience.

However, on the right-hand side, you can see that if required – for high involvement purchases, or for purchases that the consumer lacks the appropriate experience and knowledge of pricing as a result – they will seek out additional EXTERNAL information.

This pricing information is typically obtained through marketing stimulus in the environment, including:

- advertising that includes price information

- in-store and online pricing information

- comparative websites that compare on price and product features

- recent sales promotions and discount offers

- recent special offers sent to them via email or text messages

- viewing influencer blogs and videos

- asking salespeople

- asking online forums and discussion groups and social media

- asking family and friends

- plus, other appropriate marketing materials and information

Internal and External Reference Prices are Interrelated and NOT Independent

If the consumer accesses external reference price information, it is also compared to any internal reference price information.

In some cases, if the product purchase is completely new to the consumer, or it is a new-to-the-world product, then the consumer will be completely reliant upon external reference price information to help guide their decision-making.

However, for most product categories, consumers through their life experience will have some general ballpark feeling or understanding of approximate price points. If the external price information is believable and credible, then the consumer will modify their internal price range accordingly.

But if the external price information is unbelievable and incredible, then the consumer is likely to ignore the external reference price information and rely upon their internal information only.

An example where this could be possible is a store that attempts to sell products well above normal prices. For example, they offer a lesser-known brand of sport shoes, where they have a “special offer discount” of these breakthrough shoes for only $500.

Although the consumer in question rarely buys sport shoes, the external price information seems to be well above their internal reference price range – as a result they reject this piece of external price information as being valid.

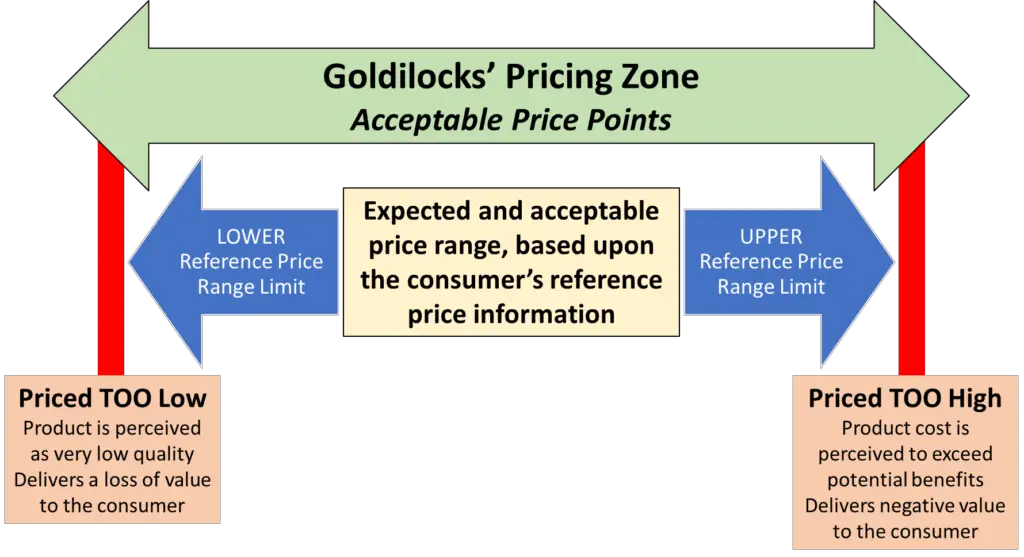

Reference Price Information Creates an Expected Price Range

As shown in the model, either the internal reference price information, or the combined internal and external price information is then utilized by the consumer to frame an appropriate price range of suitable prices – this becomes the EXPECTED price range.

In this case, the consumer constructs an approximate range of what are suitable prices. Products priced above or below this range are rejected as suitable purchase possibilities.

Products priced too high – above the price expectations of the consumer – a deemed inappropriate because they no longer represent good value purchases as the cost is likely to exceed the benefits gained from the purchase.

Products priced too low – below the bottom of the price expectation range – are considered to be low-quality and inferior products by the consumer. As a result, they are ruled out as suitable purchase options because they are unlikely to deliver suitable benefits, even at such a low price.

An example here could be a restaurant or fast-food offering. Let’s assume that in a country the average Big Mac price is $3 for the McDonald’s burger. However, if there is a small fast-food store offering quality burgers for just $0.50, most consumers would reject this as a suitable choice because it would be assumed it would be using very low quality ingredients and probably would not taste great and potentially would not be healthy for you.

The “Just Right” (or Goldilocks) Pricing Zone

This is leads us to the second part of the reference price model, where consumers are looking for products that fall into their expected and acceptable price range. This can be similar to the Goldilocks zone that is used by astronomers to identify potential planets that could sustain life – as they are situated “just the right” distance from their star.

Likewise, it is with pricing, consumers need to perceive that the product offering needs to be in the appropriate pricing range, based upon their internal and external reference price information.

It is a Range of Expected Prices – Not a Set Price

This does not mean that consumers expect all similar products to be price the same. Consumers are willing to pay additional price for well-known brands, or products with additional features, or products supported through additional services, or sold through particular retailers.

The consumer will take the package of benefits and product features into consideration when constructing their range of expected prices. For example, a consumer would have a higher expected price range for an Apple computer, as opposed to an unknown branded computer.

Related Articles