Up-selling and cross-selling are important aspects of building customer relationships and increasing customer lifetime value.

Primarily they are both sales functions, but can occur with direct and digital marketing techniques as well.

What is up-selling?

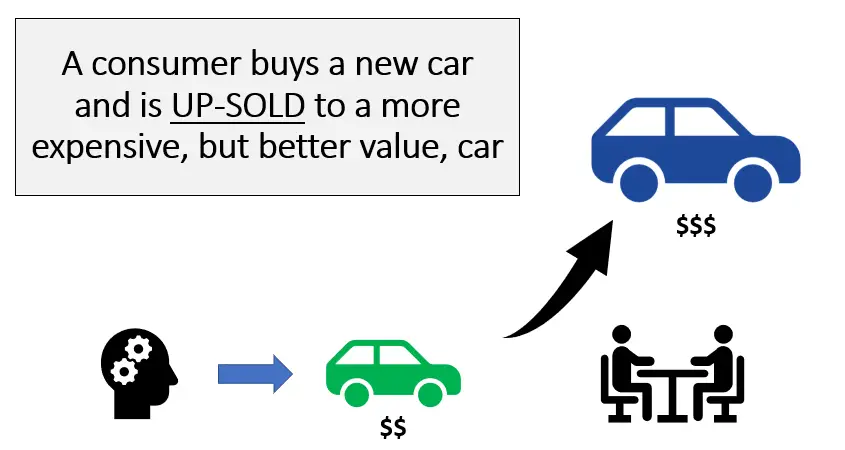

Up-selling is changing the consumer’s decision from a lower priced product to a higher priced product. In other words, the consumer “ups” the amount of money that they spent on the transaction.

Examples of up-selling

Some examples of up-selling would include:

- Airline consumers selecting “premium economy” seating, rather than normal economy class

- Banking customers taking out a platinum credit card, as opposed to a standard everyday credit card

- Diners in a restaurant ordering a more expensive meal at the suggestion of the serving staff

- A car buyer buying a new car with more options and extras then they were planning to, due to the advice of the salesperson

- A computer customer buying the next laptop level up, as persuaded by the in-store salesperson

- McDonald’s selling a medium-sized drink for $4.50, whereas the large -sized drink is only $5

- And so on

Up-selling is still a win/win transaction

As you can see, in all of these examples, there is a single transaction of one product purchase. In each of these cases, the consumer has been “up-sold” to a higher priced product, which would generate a greater profit margin for the business.

However, the consumer has been willing to engage in this transaction, because they have perceived greater value in the more expensive purchase. This could be due to the products: higher quality, better value over time, better fit to their needs, and so on.

Therefore, the consumer gains additional benefits as a result of being up-sold.

Marketing tools for up-selling

There are various methods of influencing consumers to spend more on a better quality and better value product. Some of these include:

- A salesperson interaction

- A comparison table of products and their features

- Pricing in a manner to encourage a higher purchase

- Increase promotion for high-value products

- Use of in-store displays to promote these products

- Direct marketing that only offers the higher value products

- Effective use of sales promotions and special deals

- And, in some circumstances, high-pressure selling

What is cross-selling?

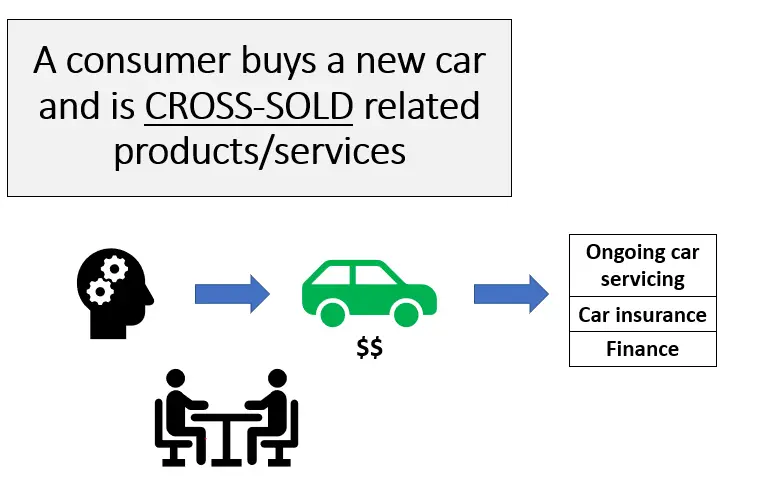

Like up-selling, cross-selling is designed to generate more revenue from the customer. But in this circumstance, instead of selling more expensive products, the business seeks to sell additional products or a greater volume of products to the same consumer.

Cross-selling is very effective in strengthening customer relationships, as the business gains a higher “share-of-customer” with less opportunities for competitors to win customer’s business.

Examples of cross-selling

- “Would you like fries with that?” – is a classic example from McDonald’s in cross-selling

- A bank selling a credit card to a home loan customer

- Special discounts for larger purchases – e.g. “buy three, get one free”

- A restaurant selling additional beverages and dessert to their diners

- A fashion store persuading its customers to buy accessories and other clothing to match

- Car dealers selling ongoing car repair services to a new car buyer

- Retailers of more expensive products selling insurance for the product

- Retailers that provide finance to the consumer

- And so on

As you can see, these tend to be related purchases that are designed to add increase value overall to the consumers purchase. So like up-selling, cross-selling should also result in a win/win transaction for the consumer.

Marketing tools for Cross-selling

Similar to the list above, the marketing approaches for effective cross selling include:

- Salespeople interaction and suggestion

- Related product recommendations, as seen on Amazon and eBay

- Sales promotions that bundle related products together

- Sales promotions that have an incentive for a greater purchase

- Offering additional products for a free trial period

- Direct marketing offers and incentives

- Plus several of the approaches used in up-selling above

Why engage in up-Selling and cross-selling?

There are multiple reasons for trying to enhance the revenue stream from the customer:

- It generally increases profitability for the firm

- It is challenging and costly to acquire a new customer, so it is more often more efficient from a marketing-spend perspective to focus on existing customers

- Different customers have different needs, and other product offerings may be a better fit to their needs

- Increased cross-selling generally results in stronger customer loyalty, as the consumer has more ties to the brand

- Increased up-selling and cross-selling reduces the opportunities for competitors to win market share from your customer base

Why NOT up-sell and cross-sell?

There are risks in being too aggressive in marketing activities, especially to the existing customer base.

Up- selling and cross-selling targets are sometimes a KPI for sales and service staff. This may result in high-pressure or aggressive sales tactics. This is often known as “transactional” marketing, where the goal is to maximize the income from a customer from one transaction, rather than over their lifetime.

It is possible that this may result in customer dissatisfaction as they believe they were “tricked” into spending much more money than they originally intended. The end result of this would be the loss of the potential customer.

The other minor risk associated with these marketing practices is the cost time and effort involved. Care needs to be exercise that the investment in up-selling and cross-selling is an effective use of marketing money and sales staff time. That is, we need to consider the marketing return on investment.

Related Topics