Customers = a business

A fundamental truth is that a business only exists when it has customers, and for most businesses, the majority of their profits come from ongoing transactions with customers.

Therefore, the goal of the marketer is to understand the key opportunities to maximize profitability for the firm (or the brand) over time, and often the most viable profit pathway is NOT through the acquisition of new customers.

The main profit pathways of customers

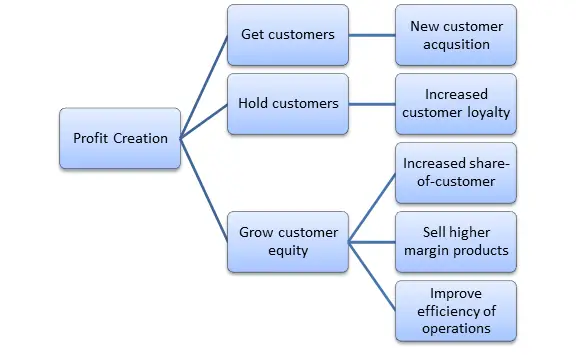

In simple terms, creating and managing customer relationships consists of three aspects:

- Acquiring new customers

- Holding customers – that is, building ongoing customer loyalty

- Growing share-of-customer

We can then further breakdown these three key elements into the following model, which indicates five main approaches to growing profitability.

New customer acquisition

New customer acquisition

The first profit pathway is probably the most obvious and often the pathway most pursued by marketers. It is simply gaining more customers. This is certainly an effective way of growing revenue, but depending upon the cost of customer acquisition and the value of the new customers, this may or may not be the optimal approach.

Certainly, all businesses will lose a proportion of their customers over time, so it is critical that customers are regularly replaced, as per the “leaky bucket” theory.

Increased customer loyalty

By increasing loyalty, we will hold customers longer AND they are more likely to buy from us during that time. In many product categories, consumers are often loyal to 2 or 3 brands at the same time.

If we can hold customers longer, then the size of our total customer base will progressively increase and will have a greater number of customers actively buying from us.

This allows us to invest more in customer acquisition, as there will be a greater payback on that investment from customer profits over time.

Increased share-of-customer

In many product categories, customers will split their purchases between competing brands. For example, the same consumer in a month may purchase from McDonald’s, KFC, Pizza Hut and Subway.

To those businesses, this consumer is a customer. Therefore, one way of increasing revenue and profitability is by gaining more of that customer’s business, which is known as share-of-customer.

Let’s use Coca-Cola as an example. Of the consumers who purchase soft drinks (or sodas), it is likely that nearly all of them would have purchased Coca-Cola at some point in time.

This means that the marketing challenge for Coca-Cola is to get existing and prior customers to purchase their products more frequently and in greater quantities.

In service firms, this is often referred to as cross-selling, where additional products are sold to the same consumer. For example, you go to buy a shirt in a clothing store, and they will likely try to sell you an additional product as well. This means that they have gained a greater share of your business = share-of-customer.

Sell higher margin products

This is known as up-selling, where the business tries to promote the benefit of a higher quality (and therefore more profitable) product to the consumer. This is very common in direct sales situations.

For example, a consumer may be seeking to buy a car at X dollars, but the salesperson convinces them to buy the next model up because of its enhanced features. Here is another example, convincing a business-class customer on an airline to fly first-class due to the additional benefits.

Up-selling involves selling a single product, but a higher quality and profit margin one, whereas cross-selling (discussed above) involves selling a additional products to the same consumer.

Increased efficiency of operations

While this may not sound like a marketing aspect at first glance, in marketing terms it means providing the product or service to the consumer more efficiently.

At this stage, we have loyal customers who buy from us on a regular basis, so we look to improve the efficiencies of our operations.

Some examples here would include:

- Banks sending out online statements rather than paper statements in the mail

- Call centers implementing automated web chats and reducing the number of physical staff, while providing an immediate response service

- Improved logistics and delivery products for efficiency

- Increased online selling, requiring less physical retail space

As you can see from the above list, each of these provide the consumer with a suitable service/product, and possibly enhanced, while significantly reducing cost to the business – having the combined impact of making each customer relationship more profitable.

Academic Readings