Contents

Quick Overview of the BCG Matrix

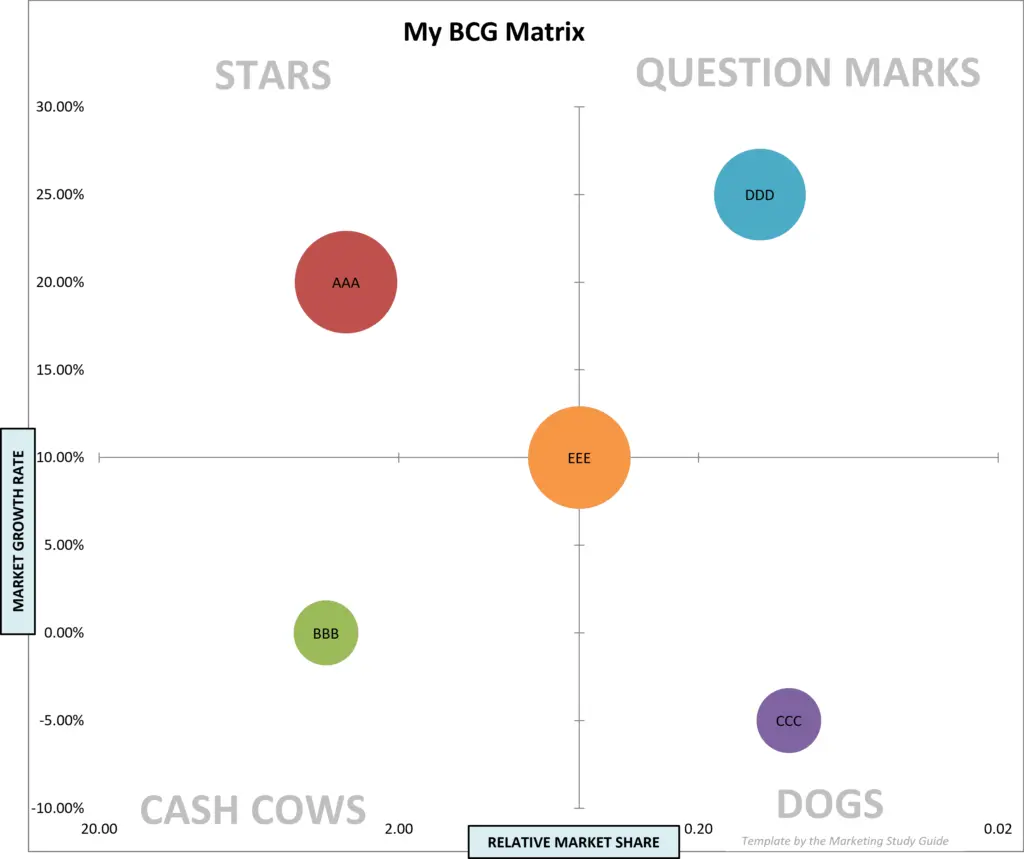

The BCG matrix, also known as the Boston Consulting Group matrix, is a strategic management tool used to analyze and evaluate a company’s portfolio of products or business units.

The matrix categorizes a company’s products or business units into four quadrants based on two dimensions: market growth rate and market share. These dimensions serve as indicators of a product’s or business unit’s relative market position and potential.

For those people familiar with the BCG matrix, you should recall that the horizontal axis measures relative market share.

This is the more important of the two dimensions!!!

A high or low relative market share makes the difference between a cash cow and a dog or a star and a question market – whereas a high or low market growth rate makes the difference between cash cow and a star (which are both good portfolios to have).

In the late 1960s and 1970s when the BCG matrix was developed and was popular in practical use, many large firms aspired to be the market leader.

The strategic thinking at that time was that large-scale production, enabled by being the market leader, led to cost leadership advantages through experience curve benefits.

Therefore the BCG matrix uses the metric of relative market share as a surrogate measure of competitive advantage.

A firm with a large relative market share advantage would also have a cost and margin advantage that would deliver a high level of profitability. Its inclusion as the main dimension in the BCG matrix is based upon the following assumptions:

- A higher market share means that production is greater and these firms can build a cost leadership advantage primarily through the experience curve benefits

- The combination of both high sales (that is, relative market share) and a higher unit margin means that the firm has much greater profitability than any of its competitors

- Because of the structure of the original definition of a cash cow in the traditional BCG matrix, they can only ever be ONE cash cow in any industry

A different competitive era?

Keep in mind that the BCG matrix was constructed in an era where manufacturing was still a significant part of the economy – therefore the underlying focus on linking market share, experience curve benefits, and profitability.

However, much the economy is now service based, the role of other competitive advantages have become more important, and the speed of technology change has dramatically increased.

What does relative market share represent in the BCG matrix?

Relative market share measures the company’s market share compared to its largest competitor in a specific market.

Why is relative market share considered the more important dimension in the BCG matrix?

Relative market share is crucial because it reflects a company’s competitive advantage and potential profitability.

How does relative market share differentiate between cash cows and dogs, as well as stars and question marks?

A high relative market share distinguishes cash cows and stars, indicating strong market positions, while a low relative market share characterizes dogs and question marks, signifying weaker positions.

Why was relative market share used in the BCG matrix?

Relative market share was utilized as a proxy measure of competitive advantage, as it was believed that market leaders could achieve cost leadership advantages through economies of scale.

What advantages does a large relative market share provide in the BCG matrix?

A large relative market share suggests greater production, cost leadership advantages through experience curve benefits, and higher profitability compared to competitors.

Does the BCG matrix ASSUME that higher market share always leads to higher profitability?

Yes, the BCG matrix assumes that higher market share, combined with higher unit margins, results in greater profitability compared to competitors.

Can there be more than one cash cow in an industry according to the traditional BCG matrix?

No, the traditional BCG matrix framework allows for only one cash cow in any given industry due to its specific definition.

Has the competitive landscape changed since the BCG matrix was developed?

Yes, the competitive landscape has evolved, especially with the rise of the service-based economy and the increasing significance of other competitive advantages beyond market share.

Are there other factors besides relative market share that contribute to a company’s competitive advantage?

Yes, in addition to relative market share, factors such as product differentiation, brand reputation, innovation, and customer service play a crucial role in determining a company’s competitive advantage.

Should companies solely rely on the BCG matrix for strategic decision-making?

No, while the BCG matrix can be a helpful framework at times, companies should consider other strategic analysis tools and factors to make well-informed decisions, given the limitations of any single model.

Related Topics