What Metrics and Data are Required for the BCG Matrix?

There are relatively few calculations required in order to construct the BCG matrix.

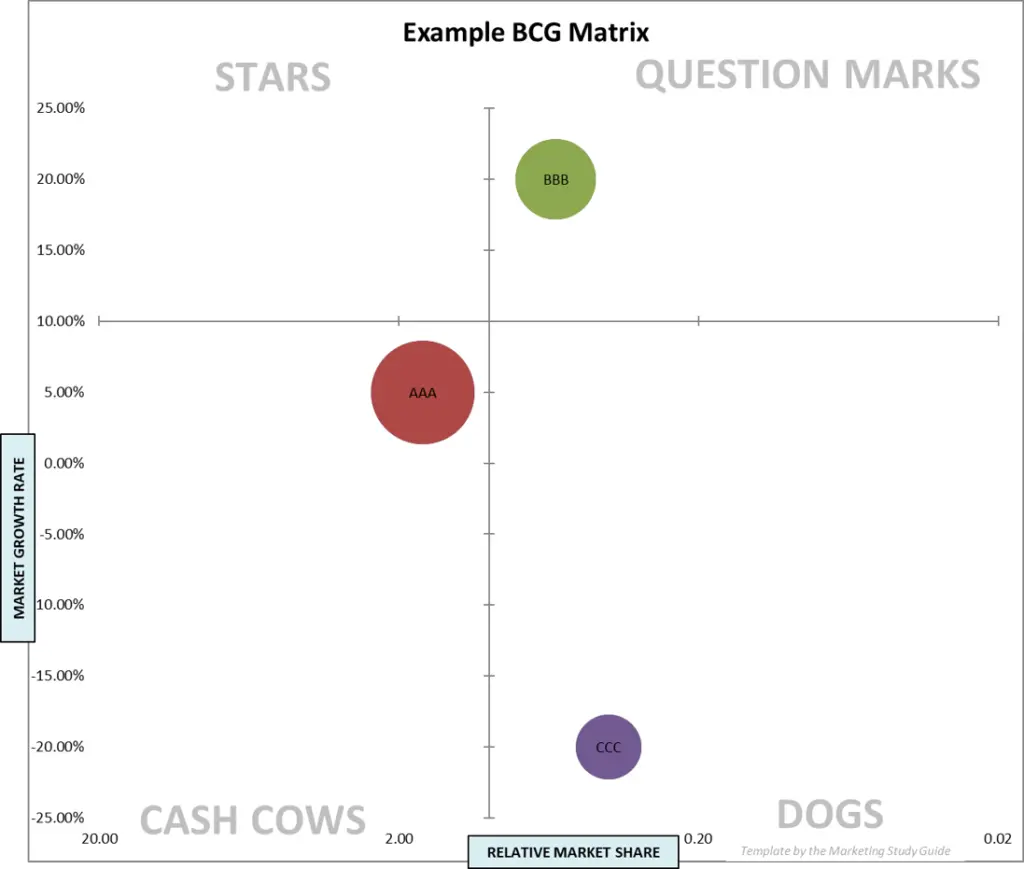

The BCG matrix consists of two metrics, namely:

- Relative Market Share (which runs horizontally on the matrix)

- Market Growth Rate % (which runs vertically on the matrix)

To calculate relative market shares, we need to know:

- The market share of the business portfolio to be plotted on the BCG, and

- The market share of each business’s largest competitor

And in order to calculate market growth rate, we need to know:

- How the firm has defined the market, and

- What are the total unit sales in that market this year, as compared to the prior year

Probably the most difficult decision above is how to define the market. While this may sound obvious, there are often numerous ways of defining the market, as will be discussed further below, or please see this article on Markets, Sub-markets and Product-markets.

For an overview of the BCG formulas and metrics you can review the below article, or alternatively you can review the summary video.

Relative Market Share Formula

Relative market share is the firm’s (or brand’s or SBU’s) market share as an index of its largest competitor. In this way, relative market share becomes a comparative measure of competitive strength.

The formula for calculating relative market share is as follows:

- Relative Market Share = Firm’s Market Share/Largest Competitor’s Market Share

For example, if a firm has a market share of 20% and their largest competitor has a 40% market share, then the firm’s relative market share would be 0.5 (that is, 20%/40%).

As another example, if a firm was the market leader and had a market share of 30% and their largest competitor had a market share of 20%, then their relative market share would be 1.5 (30%/20%) – or 1.5 times the share of the next largest player.

Remember that the vertical axis of the BCG intercepts the matrix with a relative market share of 1.0, with stars and cash cows being greater than 1, and question marks and dogs being less than 1.

Important note: Given the construction of the relative market share metric and where it is plotted on the BCG, there can only ever be ONE brand or firm in any market that would have a relative market share greater than one (that is, the market leader only) – with the vast majority of brands or firms in the marketplace having a relative market share of less than one.

This point is illustrated in this table which shows a market consisting of three firms only. As you can see, the total market share adds to 100%. The market leader (Firm A) has a market share of 50% and they are compared to their larger competitor, which is Firm B with a market share of 30%.

| Own Market Share | Largest Competitor Mkt Share | Relative Market Share | Likely Classification | |

| FIRM A | 50% | 30% | 1.67 | Star or Cash Cow |

| FIRM B | 30% | 50% | 0.60 | Question Mark or Dog |

| FIRM C | 20% | 50% | 0.40 | Question Mark or Dog |

This gives Firm A a relative market share of 1.67. However, both Firm B and Firm C are compared to their largest competitor, which is the market leader of Firm A. In both cases, by definition, their relative market share will be less than 1.0 because they are not the market leader and do not have the largest market share. And as you can see in the table, their relative market shares are 0.6 and 0.4 respectively.

This point gives rise to the most effective way of classifying between cash cows and dogs and between stars and question marks – as is discussed in an article on what cut-off point of relative market share to use when graphing the BCG matrix in today’s marketing environment. Please see the article on Where to Draw the Line?

Note on Unit Market Share versus Revenue Market Share

Traditionally, and in the original construction of the BCG matrix, relative market share has been calculated using UNIT market share.

This is because the underlying principle was that a high relative unit market share delivered profitability through the experience curve benefits and economies of scale.

The combination of these factors would give the firm a cost leadership advantage, which the firm can use for pricing discounts or superior profit margins and both of which could be leveraged to defend and grow their market share position.

Therefore, in the BCG matrix, cash cows are considered superior businesses that have relatively high unit profit margins, are able to compete on price alone if required, and generate significantly more profits than less efficient players with a small market share.

It should be that the BCG was constructed in the late 1960s where cost leadership was seen as a significant advantage in the marketplace and potentially superior to other strategies.

For students of marketing, you may be aware of Porter’s Generic Strategies which suggests that cost leadership is the preferred strategy, and if that is unavailable then you move to either differentiation or a focus strategy.

In addition, the BCG model was also developed primarily for the purpose of industrial based conglomerates, in an era where price and promotion were more prevalent, and the rate of technology change was much slower than today – resulting in more stable industries.

However, despite the above commentary, please note that it is possible to calculate relative market share – the bottom or horizontal axis of the BCG matrix – by using REVENUE (dollar) market share instead of unit market share.

For example, Apple in the smart phone market primarily competes at the premium end and do not offer budget based mobile phones. As a consequence, it would be probably more appropriate for an organization such as Apple to use revenue market share if they were to utilize a BCG matrix.

Market Growth Rate Formula

The market growth rate percentage used in the BCG matrix is a simple year-on-year growth rate. This would be calculated by:

- Market Growth Rate % = Total Market Unit Sales in the Current Year/Total Market Unit Sales in the Previous Year

Please note, like relative market share, we are using unit sales to calculate the growth rate of the market, not overall revenue. Again, the BCG is trying to identify business portfolios that would have a scale advantage and therefore a cost leadership position

As an example of the formula, if total unit sales in this year was 11 million – across ALL brand/firms – and in the previous year total unit sales was 10 million, then the year-on-year market growth rate is equal to 10% (that is, 11m/10m).

Here are three further examples in the table below. As you can see in the example for Market C, the growth rate percentage can be negative, indicating that the market is in the decline stage of its product lifecycle. There is no maximum percentage as markets may grow quickly in the growth stage of the product lifecycle.

| Last Year | This Year | Growth Rate | Likely Classification | |

| Market A | 10,000,000 | 10,500,000 | 5.0% | Cash Cow or Dog |

| Market B | 10,000,000 | 12,000,000 | 20.0% | Star or Question Mark |

| Market C | 10,000,000 | 8,000,000 | -20.0% | Cash Cow or Dog |

And as shown in the last column of the table, the overall growth rate will indicate where the portfolio may sit. Market growth rates in excess of 10% per year are reflective of the introduction and growth stage of the product lifecycle and would indicate portfolios that would be classified as either stars or question marks.

Whereas markets growing by less than 10% a year (or perhaps even negative) would be in the maturity or decline stage of the product lifecycle and would include portfolios that would be classified as either cash cows or dogs.

Annual Calculation Required

Because a year-on-year growth rate is being utilized, it becomes necessary to recalculate this metric for the purposes of the BCG matrix each year. This is important because it also allows the tracking of the portfolio over time.

Annual calculations are also required because it is very likely that the portfolio’s relative market share position will also alter each year, particularly in a competitive marketplace where firms are trying to grow and capture market share.

As a result, we will find that business portfolios may be classified into different quadrants of the BCG each year, and definitely will be over time.

As you most likely know from the mechanics of the BCG matrix, eventually most stars will become cash cow and most question marks will become dogs as the markets mature and the growth rate percentage reduces. Please see this article on how portfolios pass through the BCG matrix over time.

Market Definition

As highlighted at the start of this article, to effectively calculate relative market share and market growth rate, the firm needs to make a strategic decision about what market it is in.

While this may sound a silly question at first, it gets back to a “where to compete?” strategic question.

As an example, Burger King may see themselves as competing in the fast-food market only – whereas McDonald’s may see themselves competing in the broader market of out-of-home dining (which would also include cafés, diners and restaurants).

Therefore, their calculations of relative market share and market growth rate will differ as a consequence and generate different outcomes on the BCG matrix.

This means that although Burger King and McDonald’s are direct competitors, the construction of the BCG matrix and their overall assessment of the competitive position would differ, due to how they have defined the market in which they are competing.

Mapping These Metrics onto the BCG Matrix

If we use the two tables above, we can see that Firm A is a cash cow, while Firm B is a question mark and Firm C is a dog. This is how these firms would be plotted on to the BCG matrix, using the free BCG Excel template available on this website for download.

You should note that on the BCG matrix relative market share runs in the opposite direction to a traditional chart – where the left-hand side has the higher values, and therefore the cash cows and stars, while the right-hand side of the lower vertical market shares, and therefore the dogs and question marks.

Further Resources and Articles